reit tax benefits uk

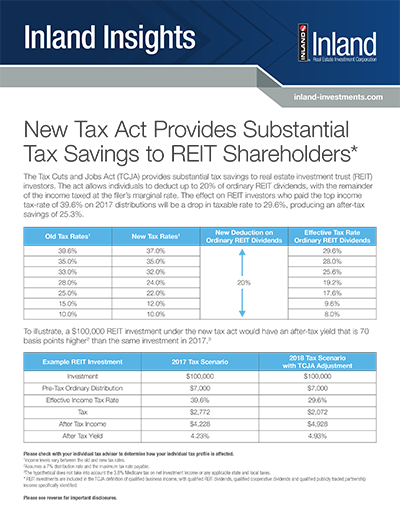

Tax benefits of REITs Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. The benefits are considerable.

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

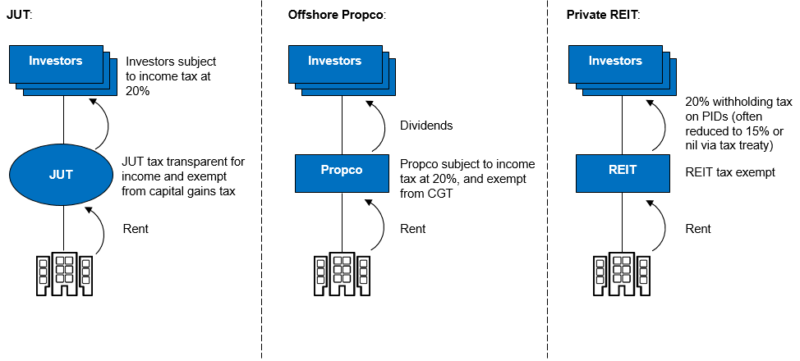

Following the consultation on the tax treatment of asset holding companies changes to the UK Real Estate Investment Trust REIT regime have been.

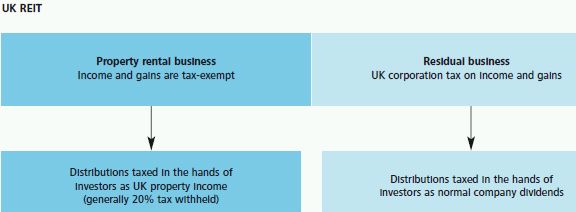

. UK REIT property income distributions are taxed as property income. UK individual basic rate 20 tax payer 69 80 158 UK individual higher rate 40 tax payer 51 60 185 UK individual additional rate 45 tax payer 46 55 185 UK company 75 75 Nil. Advantage 3 - Tax Efficiencies.

Corporation Tax is payable on its profits and gains from. Profits distributed as PID dividends are paid out of British Lands tax-exempt profits and therefore are potentially fully taxable in shareholders hands as property letting income. Investor REITs are now also regarded as institutional investors which provides further flexibility in connection with the close company requirements a property group would lose its REIT status.

Depreciation and Return of Capital. A normal UK company is required to pay Corporation Tax on profits at a rate of 19. 7 Distributions are not guaranteed and may be funded from.

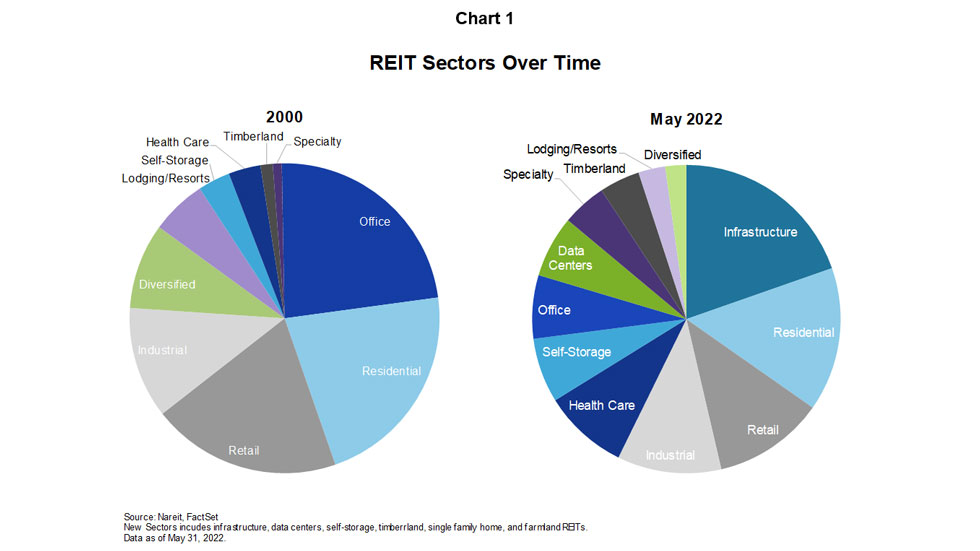

It offers exposure to a portfolio of Urban and Big box warehouses in Europe with a combined value of 184b. The main rules for UK-REITs were introduced as FA 2006 Part 4. They were first developed in the US but were introduced in the UK in 2007.

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. See the Notes about Part C. The largest UK REIT is Segro SGRO with a market cap of 124b.

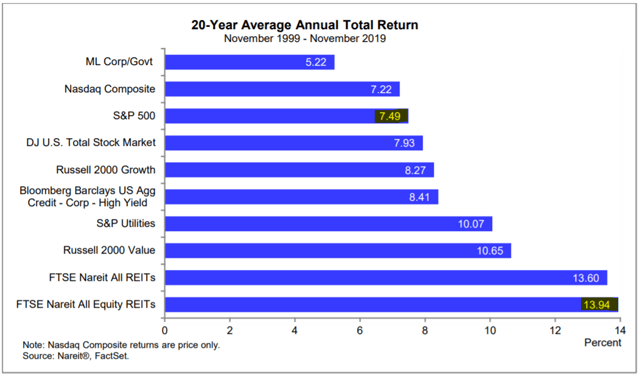

A UK-REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property. Subsequent changes to the regime have been. In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions.

2 August 2021. In the year ending 31 March 2022 Custodian acquired another UK REIT named Drum which comprised of 10 properties 79 tenants and a contractual annual rent roll of 33m. Real estate investment trusts REITs are tax efficient property investment companies.

Real estate trusts are a different animal from typical corporations. To fill in the details below use the information on the tax vouchers. REIT Tax Benefits No.

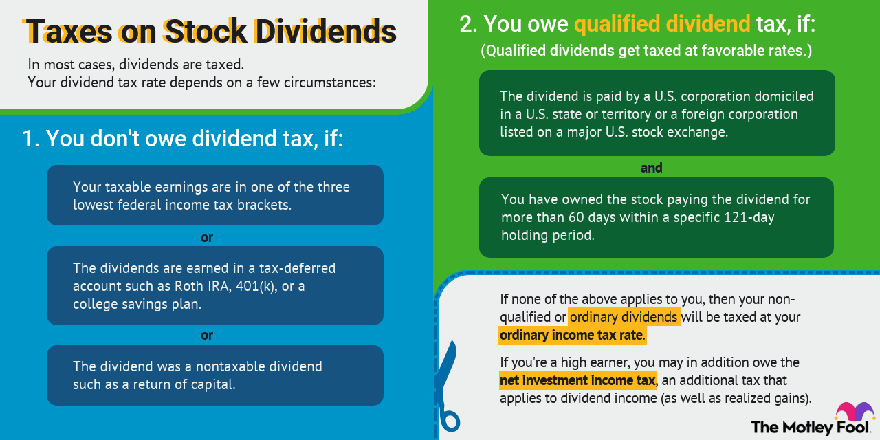

These property-owning companies receive tax benefits in return for paying out most of their income as dividends. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. These three REITs have an average dividend yield of 67.

After tax return from UK company After tax return. So it makes sense that their accounting practices. The appeal of the UK REIT continues to grow since its introduction in 2007.

REITs are generally tax-efficient vehicles that allow investors to avoid being double taxed. REITs benefit from some pretty special tax advantages. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs.

For information about UK-REITs see note 2 in the UK-REIT DT-Individual Notes. The REIT is exempt from UK tax on the income and gains of its property rental business. UK REITs are not taxed at the corporation level the REIT dividends paid out to.

REITs are exempt from corporation tax on profits generated from rental income and the income from the sale of rental properties making them a tax-efficient investment choice. It also enables exempt investors to benefit from their own tax status.

Uk Reits An Attractive Vehicle For Uk Property Investment Pwc Uk

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

The Continuing Rise Of The Reit

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Doing Business In The United States Federal Tax Issues Pwc

The Uk Asset Holding Company Regime A Quacking Idea

Reits Support Completion Portfolios With Increased Returns And Lower Volatility Nareit

Top Reasons To Not Invest In Reits Seeking Alpha

Congress Looks At Reit Tax Exemption Wsj

Hotels In Name Only The Strange Case Of Lodging Reits

The Taxman Cometh Reits And Taxes

The Tax Benefits Of Investing In Multifamily Real Estate Penn Capital Group Acquisition Preservation

Reits Explained Types Alternatives Pros Cons Arrived Homes Learning Center Start Investing In Rental Properties

Uk Reits A Summary Of The Regime Fund Management Reits Uk

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

Industrials Reit What Is A Reit

Quoteddata S Real Estate Roundup September 2021 Quoteddata