kansas sales tax exempt form agriculture

Farming or ranching as any activity which is ordinary and necessary for the. Exemption Certificates Agricultural Exemption ST-28F Created Date.

New Ag Census Shows Disparities In Property Taxes By State

The Kansas exemption certificates that begin on page 15 meet these requirements.

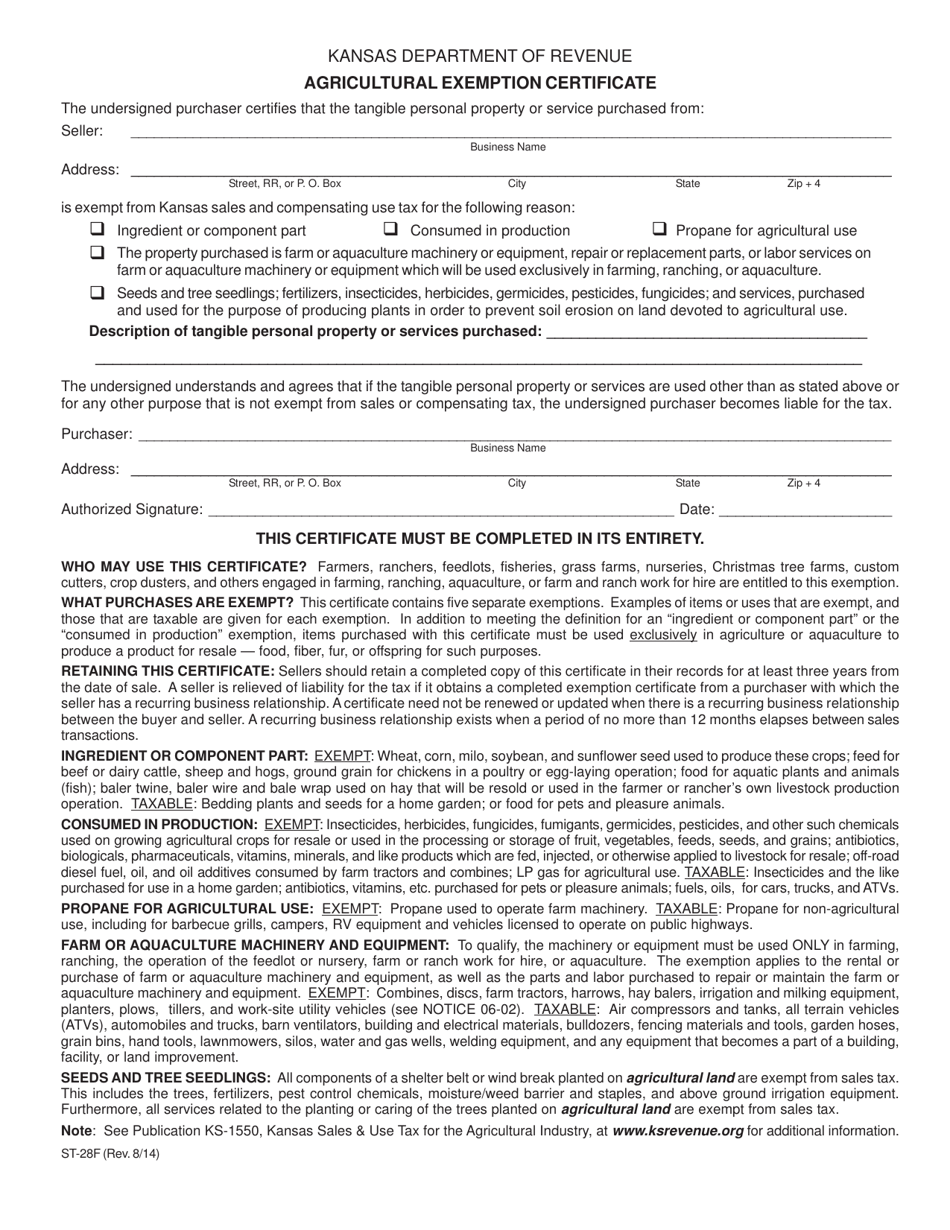

. Consumed in production exemption items purchased with this certificate must be used exclusively in agriculture or aquaculture to produce a product for resale food fiber fur or offspring for such purposes. ST-28F Agricultural Exemption Certificate. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. This includes the trees fertilizers pest control chemicals. For the purpose of applying sales tax Kansas tax law defines.

Furthermore all services related to the planting or caring of the trees planted on. While groceries are not tax exempt any food that is used to provide meals for the elderly or homebound is considered to be exempt. The application will provide definitions explain the assistance process in detail and will specify exactly what information must be provided andor submitted in support of the application.

On average this form takes 2 minutes to complete. Documenting exempt agribusiness sales. Furthermore all services related to the planting or caring of the trees planted on.

In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The following are eligible for agricultural exemption in Kansas. Wheat corn milo soybean and sunflower seed used to produce these crops.

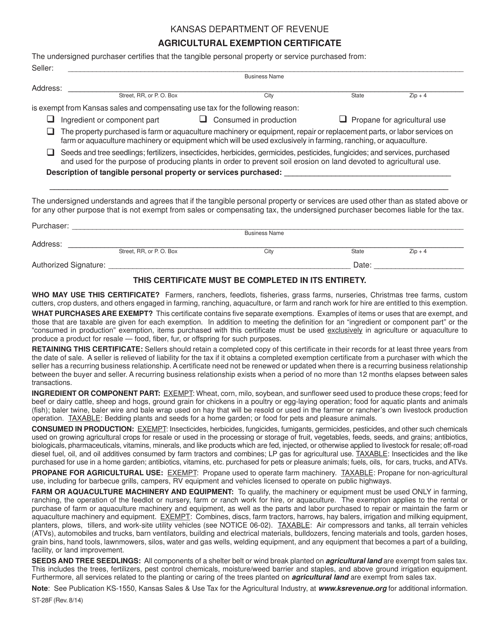

The KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE form is 1 page long and contains. 1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource for commonly sought information. Property purchased is farm or aquaculture machinery or equipment repairreplacement parts or labor services on farm or aquaculture machinery.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment. Once completed you can sign your fillable form or send for signing.

Are exempt from sales tax. The exemption certificates for nonprofit organizations require the exempt entitys tax ID number. Are exempt from sales tax.

Ingredient or component parts. Are exempt from sales tax. Propane for agricultural use.

Seeds fertilizers insecticides herbicides germicides pesticides. It combines four of. The exemption from collection of the sales tax does not apply to agricultural producers who purchase livestock poultry or other farm products for resale.

They must collect and remit the tax or obtain from the purchaser a properly completed exemption. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a. Farmers must maintain adequate records to support the exempt status of their sales.

Are exempt from sales tax. 1 growing or raising of agricultural products 2 the operation of a feedlot. Furnish the Kansas tax account number or request a description of the buyers business.

Or 3 farm and ranch work for hire. That means that items available under the exemption are only available as exempt if the purchaser will use the equipment 75 or more of the time for exempt usesThis declaration is made at the time of purchase by filling out Form S-3A. Parts consumed in production.

See Publication KS-1550 Kansas Sales Use Tax for the Agricultural Industry at. All construction materials and prescription drugs including prosthetics and devices used to increase mobility are considered to be exempt. Furthermore all services related to the planting or caring of the trees planted on.

Are exempt from sales tax. This certificate may be used to claim the exemptions for farm machinery and equipment ingredient or component parts consumed in production and propane for agricultural use. Street RR or P.

Are exempt from sales tax. The seven exemptions available to agribusiness on one form. In addition the Department is in the process of developing the application that will be submitted to apply for assistance through the COVID-19 Retail Storefront Property Tax Relief Act.

This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment. All forms are printable and downloadable. Therefore anyone engaged in the production of agricultural commodities.

This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment. Furthermore all services related to the planting or caring of the trees planted on. Agricultural Exemption ST-28F Rev.

INGREDIENT OR COMPONENT PART. Are exempt from sales tax. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase.

The exemption available to agricultural and horticultural entities for machinery and equipment is a use-based exemption. Are exempt from sales tax. Box City State Zip 4 is exempt from Kansas sales and compensating use tax for the following reason check one box.

Are exempt from sales tax. Are exempt from sales tax. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE.

The requirement also applies to Form PR-78SSTA. This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment.

It S So Important To Elect Portability For Your Farm Estate Agweb

Agriculture News Hardin County

How To Start Homesteading In Missouri Hello Homestead

How To Start Homesteading In Kansas Hello Homestead

Ecosystem Services Markets For Farmers In Minnesota Tnc

Fertilizer Shortage Impact 2022 Crops Supply Chain Crisis

Is My Purchase Taxable Stillwell Sales Llc

Effect On Family Farms Of Changing Capital Gains Taxation At Death Morning Ag Clips

Texas Supreme Court Holds Farm Animal Liability Act Inapplicable To Ranchers Ranch Hands Texas Agriculture Law

Survey Of Bankers Shows Concern About Farm Debt And Low Income 112520 Debt Banker Income

Form St 28f Download Fillable Pdf Or Fill Online Agricultural Exemption Certificate Kansas Templateroller

Johnson County Farm Bureau Association Home Facebook

Form St 28f Download Fillable Pdf Or Fill Online Agricultural Exemption Certificate Kansas Templateroller

Form St 28f Download Fillable Pdf Or Fill Online Agricultural Exemption Certificate Kansas Templateroller